Tax Advisor AI

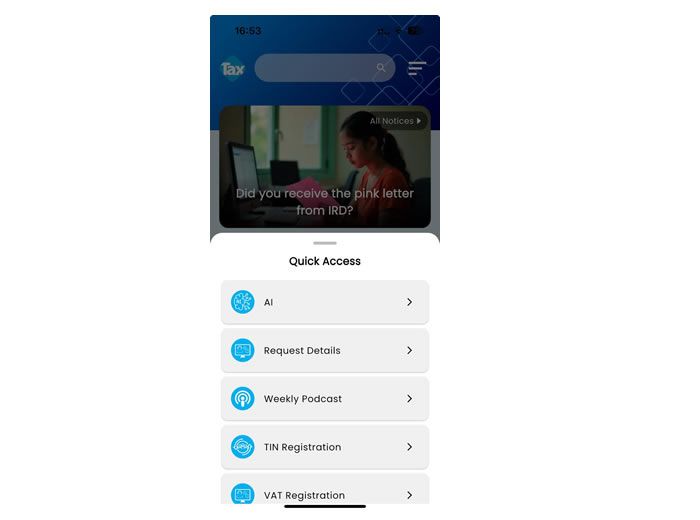

Began AI testing and proudly launched Tax Advisor AI

Available via Web & WhatsApp, giving you 24/7 access to Sri Lankan tax knowledge.

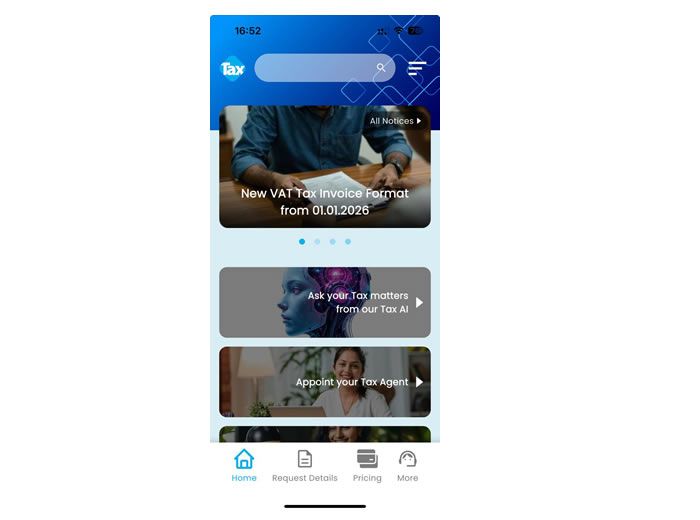

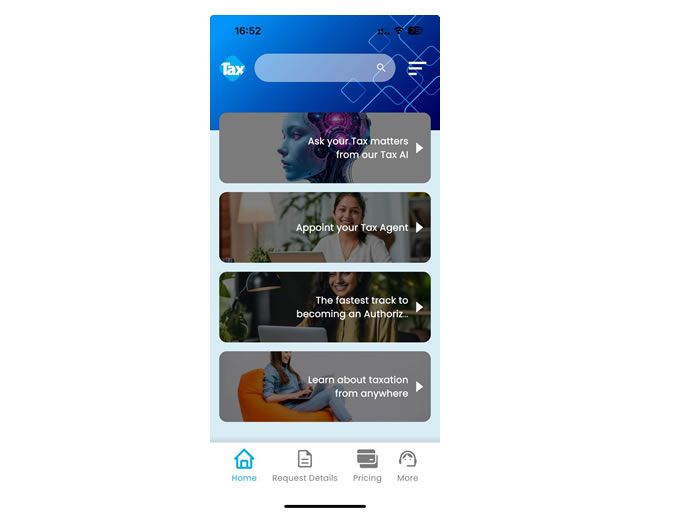

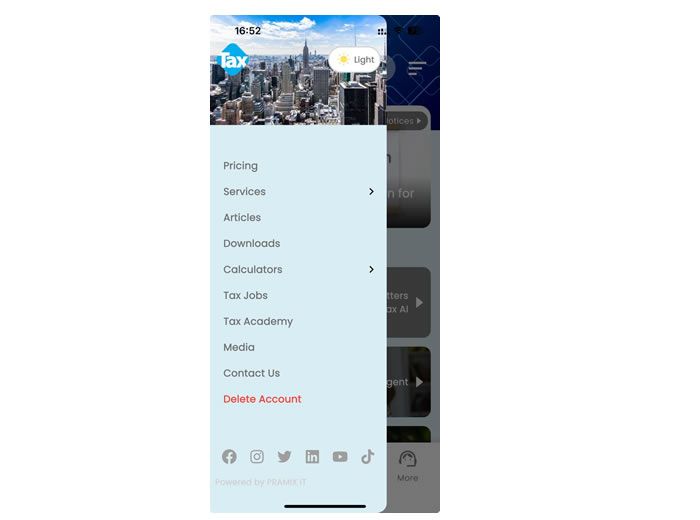

NOW TRULY AT YOUR FINGERTIPS

Tax Consultation

Book your consultant at your convenient time and meet subject-matter experts for every tax need.

TAX CONSULTATIONS MADE EASY

Latest

Articles

- Proposed Amendments in Inland Revenue Bill 2026

- Tax Privilege Systems in Sri Lanka and Other Countries: How They Work and What Sri Lanka Can Improve

- Colombo Port City Economic Commission (Amendment) Act, No. 1 of 2026 – Key Changes & Impact Summary

- Social Security Contribution Levy (SSCL) – Key Changes Explained

- From Crisis to Confidence: Key Insights from the 27th Annual Tax Oration of CA Sri Lanka

Latest

Downloads

- Inland Revenue (Amendment) Bill - (Bills)

- Colombo Port City Economic Commission (Amendment) Act, No. 1 of 2026 - (Acts)

- Consolidated Text of the Value Added Tax Act, No. 14 of 2002 [Incorporating Amendments up to 31.12.2025] - (Acts)

- Social Security Contribution Levy (Amendment) Act, No. 24 of 2025 - (Acts)

- Betting and Gaming Levy (Amendment) Act, No. 25 of 2025 - (Acts)

Prof. A. Chamaru De Alwis

"First of all appreciate your great excellent work.

Actulay , this is the first time we are experiencing such a valuable updated, speed, accurate, user friendly and professional service in Sri Lanka.

Best wishes for more unique ideas"

Professor in Management

Department of Human Resource Management

University of Kelaniya, Sri Lanka

Peter Fleming

"In late 2018, I engaged the services of Mr Viraj of Taxadvisor.lk to help us register VAT for our company Deskera (www.deskera.com) and despite a tight deadline and some complications, we were able to succeed. I would therefore be pleased to recommend these services."

CFO, Deskera

Singapore

Ruwan Wanniarachchi

"We highly appreciate your SMS service. The excellent solution offered by you,has taken a huge load off our shoulders. If possible, please send a reminder before 4 working days regarding the deadline of the relevant payment/report. Then it will be very useful to the persons who are dealing with those."

Head of Finance

Siyapatha Finance PLC

Thushara Amarasinghe

"I strongly believe that this service is an innovative thing which will give great help to tax paying community as well as tax practitioners to keep their knowledge updated and ensuring tax compliance on time."

Chief Financial Officer

Continental Insurance Lanka Ltd

Do You Know ?

Proposed Amendments in Inland Revenue Bill 2026

The explanations provided below are based on the proposed changes contained in the Inland Revenue (Amendment) Bill, 2026. These changes reflect the amendments currently...

Tax Privilege Systems in Sri Lanka and Other Countries: How They Work and What Sri Lanka Can Improve

Many countries today use tax privilege and recognition systems to encourage taxpayers to comply voluntarily. Instead of depending only on penalties and audits, tax...

Colombo Port City Economic Commission (Amendment) Act, No. 1 of 2026 – Key Changes & Impact Summary

1. Employment Income Tax Exemptions Original Act (2021) The Act empowered the Commission to grant incentives to Businesses of Strategic Importance (BSIs), including:...

Social Security Contribution Levy (SSCL) – Key Changes Explained

The Social Security Contribution Levy (Amendment) Act, No. 24 of 2025 amends the Social Security Contribution Levy Act, No. 25 of 2022. This amendment mainly focuses...

Our Strategic Partners

Corporate Tax Partner

Dasanayaka Associates (DA) is a firm of Chartered Accountants specialized in Tax and Regulatory Consultation.

Valuation Partner

IJVR, over the years has evolved to become the most sought after and trusted Real Estate valuation and Consultancy firms as a foremost brand in valuation and real estate entities in Sri Lanka